The reference number is the number located underneath the Beneficiary details and above the notice in the purple box.

With the reference number, we are able to make sure your SWIFT deposit will go directly into your SwissBorg app account as fast as possible by identifying you in the system. Please make sure you use it every time.

If you happen to send money without the reference number, we will not know to whom the deposit belongs. This would then require an investigation on our side, which could take a long time, further delaying the arrival of your deposit.

Think of it this way. Sending money without the reference number is the same as putting a 2'000 EUR package in front of the bank door without any details about the receiver. The bank will not know into which bank account the money should go.

You can read more about the topic in the missing reference number help centre article.

The reference is currently needed only for the following currencies:

- EUR (for Global Transfers only)

- GBP (for Global Transfers only)

- AED

- CAD

- HKK

- ILS

- SGD

What if my bank doesn't have a reference number?

In different banks and their apps, the reference number might have a different name. Some common examples include:

-

Reason for payment

-

Message for the beneficiary

-

Title

-

Transfer title

-

Line reserved for communication

-

Transfer notification/statement/communication

-

Their Reference/Recipient Reference

-

Subject

-

Recipient Message

-

Description

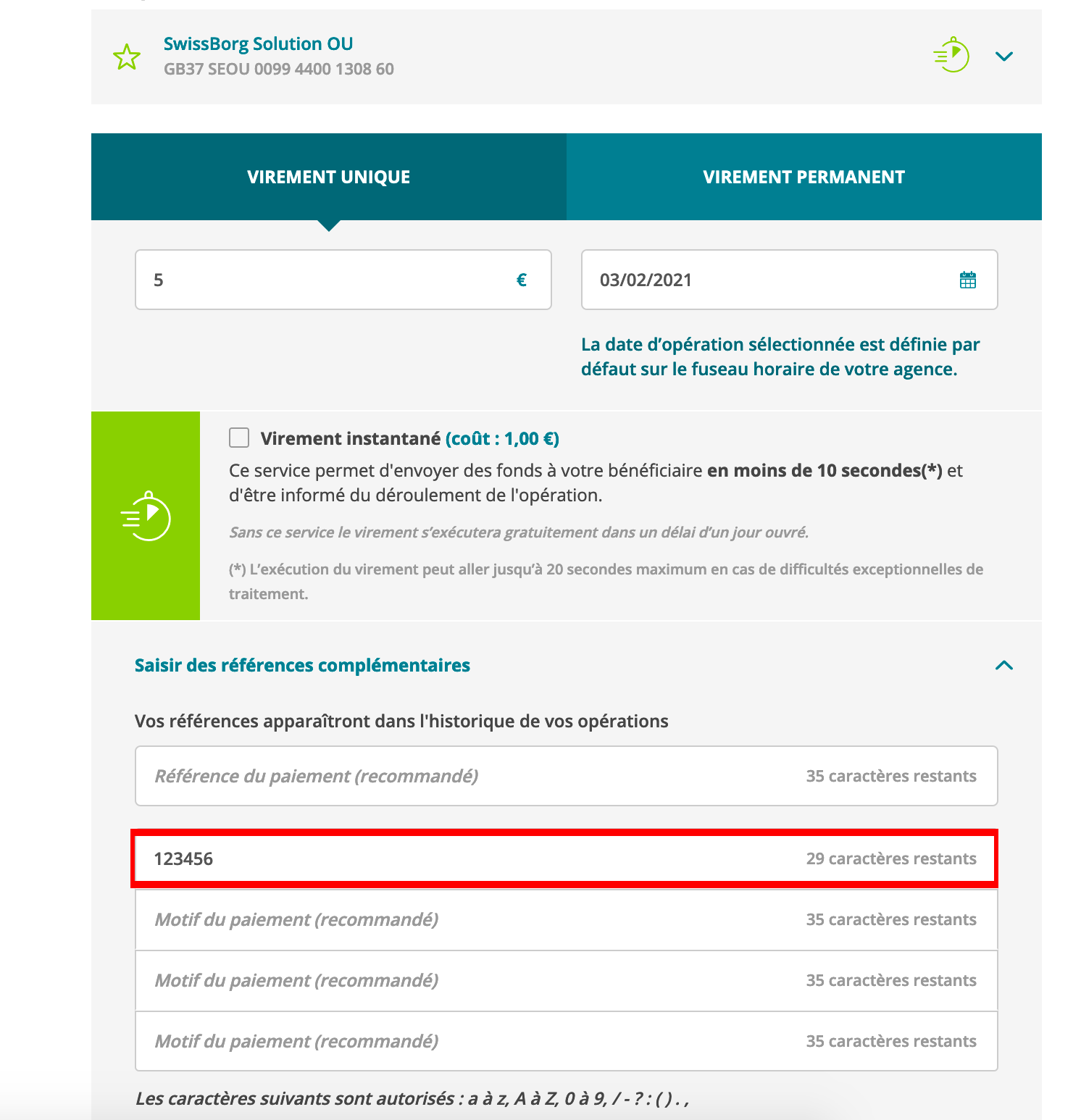

Below, you can see screenshots of different banking apps and the naming they use for the reference number field.

Airsoft France

BCF - Banque Cantonale de Fribourg

BNP Paribas

Boursorama Banque

Caisse D'epargne

Comdirect

Credit Agricole

Credit Suisse

Crédit Mutuel

Ersparniskasse Schaffhausen AG

FNB (First National Bank)

Fortuneo

HELLO BANK

ING

Intesa Sanpaolo

mBank

Monzo

N26 France

NEON

Nordea Finland

OTP Bank

PKO BP

Raiffeisen

Santander

Société Générale

UBS

Your banking app is not on the list? Send us screenshots, tell us what the reference number field is called in your app, and we'll add it to the article. Happy investing with SwissBorg!